Need to understand your finances, get a handle on your expenditures, or check your credit score? To assist you in managing your financial situation, we test and evaluate the best financial software.

Due to the ongoing COVID-19 pandemic and high inflation in 2022, financial worry is at an all-time high over the world. Regardless of whether you’ve had any huge shocks, it’s crucial to know where you stand with your money. After all, nobody can say with certainty where they’ll be in a month, six months, or a year.

Pay careful attention to your cash flow, spending habits, budget, and investments. If you want to take on debt, your credit score is also a major factor to consider. To make better, more knowledgeable judgments about spending and credit, the finest personal finance software helps you keep track of your money. The majority are inexpensive, if not free. The best ones are discussed in this article.

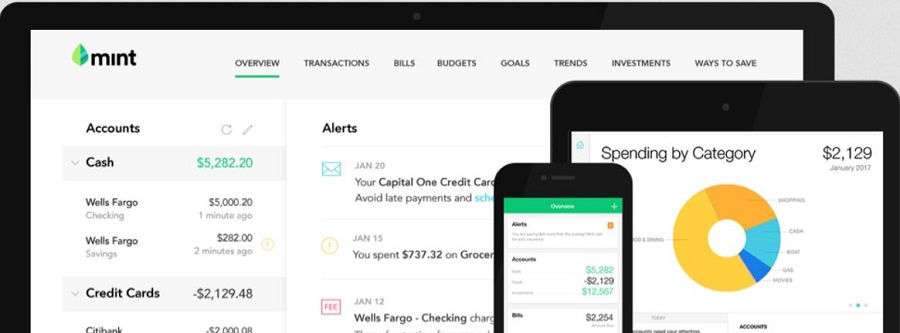

The Best Personal Finance Software in 2023: Mint

PROS

- It’s quick, simple, and free

- Effective application of AI and robotics

- Tools for easy budgeting

- Useful alerts

- Maintains a record of your credit score

- Excellent Mobile Apps

CONS

- Limited ability to monitor investment performance

- Financial product advertisements that are intrusive

Because of its ease of use, intuitive design, and innovative financial tools, Mint has long been the gold standard for personal finance websites. Among other financial management chores, it enables you to access all of your online financial accounts, monitor your credit score, plan your finances, and calculate your net worth. You have nothing to lose by giving Mint a shot because it’s cost-free to do so.

Who It’s For

There should be mint in everyone’s lives. Almost anybody can keep a close eye on their money because to its simplicity of use, innovative data and tool display, and savvy personal finance tools. You can keep tabs on your earnings and expenditures, as well as your savings and investments, with the help of Mint. Both financial novices and seasoned money managers can benefit from it because it is both straightforward and thorough.

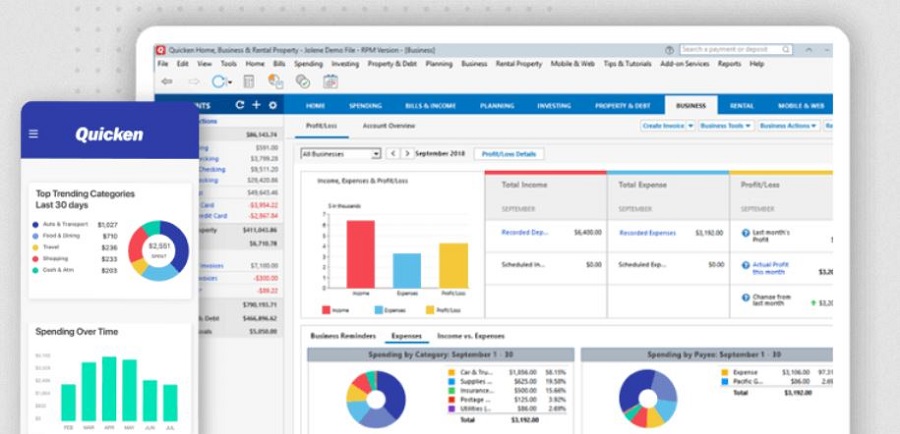

The Best Personal Finance Software: Quicken Deluxe

PROS

- Personal finance, planning, and investment tools that are robust

- There is now a consolidated view of data on a single screen.

- The linked companion website is superb.

- Comprehensive, transaction-tracking capabilities

- Excellent Access to Help

CONS

- The user has an inconsistent experience

- Inability to pay bills online

- Some people may find it intimidating

In the decades since its inception, Quicken has been a trusted tool for keeping track of finances. It has grown to be the most feature-packed personal finance software on the market. Quicken Deluxe for Windows is desktop software that syncs with a web-based companion app, so you can access your financial data from anywhere, at any time. Every aspect of personal finance is supported by the software, including basic account management, budgeting, bill paying, and investing.

Who It’s For

If you’re an expert with your personal finances and don’t mind having an app installed on your desktop, Quicken Deluxe for Windows is the way to go. A new user may want to start with Quicken Starter, while those with more complex needs, such as those involved in planning, investing, or managing the money of a small business, may want to upgrade to one of the other three available editions of the software. If you’re used to working with Windows, you’ll have no trouble with it.

Best Personal Finance Software: Credit Karma

PROS

- Two credit scores, updated daily, are available for free

- Photos of credit cards

- The motor insurance premiums may be lowered by using the bill pay drive function

- Outstanding Mobile App

CONS

- Recommendations for various financial products are everywhere

- does not relate to financial institutions

- Needs to restructure their operations

Not only does Credit Karma keep you abreast of your credit score, but it also alerts you to any potential security breaches. It also features tools for locating competitive rates on a wide variety of financial products, including credit cards, loans, automobiles, and car insurance. Credit Karma not only provides you with your credit score, but also explains how it was calculated and what you can do to raise it. It’s completely free and accomplishes all it says it will. The site’s information is made accessible on the go with excellent mobile apps.

Who It’s For

Because of its innovative training tools, Credit Karma is especially useful for people who want to raise their credit scores. Those who already have excellent credit ratings can utilize the service to monitor any changes to their ratings and to shop for more favorable financial products when the time is right.

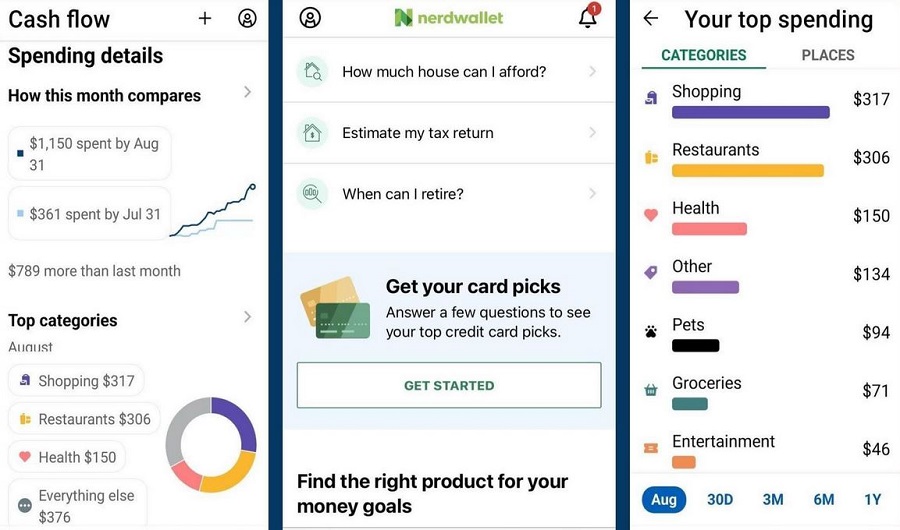

Personal Finance Software 2023: NerdWallet

PROS

- Account management is a part of this

- examines cash flow, net value, and credit score

- Numerous helpful tools, including editorials and calculators

- Analyses and rankings of financial products

- Fewer ads that don’t leave you wanting more

- Free

CONS

- Simpler handling of financial transactions

- There are only a handful of types of commercial transactions

- Is, at times, overly dependent on scrolling

NerdWallet provides consumers and small companies with the tools, knowledge, and data they need to make better financial decisions. Articles about personal finance and advertisements for credit cards, mortgages, and other financial products make up the bulk of this material. NerdWallet, like many of the top personal finance apps, allows you to monitor your wealth and income as well as gain insight into your credit score.

Who It’s For

NerdWallet is an excellent option for anyone in need of ad-free financial account management and credit score management. While advertisements have always been a necessary evil in order to fund new material and new tools, a recent redesign has made them much less obtrusive, leading to a much more pleasant experience overall.

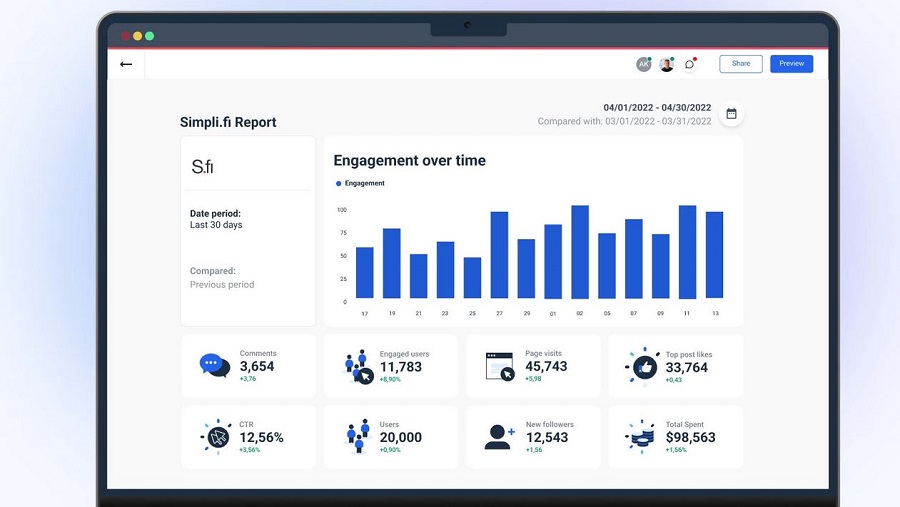

Personal Finance Software: Simplifi

PROS

- Highly intuitive interface and excellent dashboard

- Effective budgeting and monitoring thanks to a well-organized system

- Positive updates

- Excellent Mobile Apps

CONS

- Payment for Membership

- Failing to meet minimum credit score requirements

- Simple billing monitoring

- Functions that are less than ideal for those who work for themselves

Although Simplifi by Quicken has only been available for a short period of time, its rapid development into a top-tier personal finance website has amazed us. Your finances are quickly outlined in a clear and useful dashboard. You can stay on top of your finances with the help of the latest innovations in data visualization (such as spending plans, watchlists, and reports).

Who It’s For

Simplifi was created by the same people that made Quicken, but it is not a watered-down version of that program. This app is aimed at a younger audience that wants to maintain tabs on their financial accounts, monitor their day-to-day spending, and work toward savings objectives without spending hours reading over charts, lists, and reports.